Toyohiko Kagawa serialized in “Ienohikari (Light of home)”

His novel complained cooperatives insurance by credit cooperatives

“The Land of Milk and Honey” that Kagawa serialized in Monthly magazine “Ienohikari (Light of home)”

Toyohiko Kagawa wrote a society faction novel in which he themed the cooperatives. It was “The Land of Milk and Honey” that Kagawa serialized in Monthly magazine “Ienohikari (Light of home)” for two years since January 1934. This became a big reputation so that publication number of copies of the magazine reached 1 million copies.

The stage of the novel was poor village of Aizu area of Fukushima prefecture. Facing rural lives difficult due to cold weather damage, main character, Tosuke Tanaka, went out to the capital. Soon he took pneumonia and entered to Nakano cooperatives hospital. He learned sangyokumiai (cooperatives) including medical cooperatives. After coming back to home town, Tosuke established sangyokumiai (cooperatives) and became senior managing director. As the same as historical facts, at the 20th national sangyokumiai (cooperatives) congress, he preached the importance of life insurance and proposed that it should be run by sangyokumiai (cooperatives).

In the final episode of the series, Kagawa made the hero of his novel to say as follows; “Gentlemen, Japanese credit cooperatives have the same degree of risk as commercial banks. Faced a little recession, members of credit cooperatives tend to withdraw their time deposits without waiting deadline.” “The only way to prevent this danger is the life insurance run by credit cooperatives. Because life insurance is time deposits until death.” “Today, life insurance companies collect the largest sum of money. I want central Bank of credit cooperatives to start the business of life insurance cooperatives, or to buy life insurance company so as to run it by the spirit of sangyokumiai (cooperatives) ・・・”

After serialized this novel, the following year, Kagawa has published a paper entitled “Claim the insurance system run by cooperatives.” In the paper, Kagawa said, “There are many people to preach the limits of cooperatives. But such limits derived from the difficulties and limitations of the long-term funding for cooperatives. Therefore, if cooperatives continued running only just four types of business current permitted by law such as credit, sales, purchasing, and utilization, it would be inevitable to be limit.” “We have already taken the first steps to claim the National Health Insurance operation run by sangyokumiai (cooperatives). In addition, we would like to achieve the entire insurance system run by cooperatives, in particular, fundamental life insurance system should be run by cooperatives in order to achieve our purpose.” In this way he had prompted the insurance management by sangyokumiai (cooperatives).

Study of cooperatives insurance also progressed rapidly. Noah Bar, Russian cooperatives researcher living in UK, published “Co-operative insurance” in 1936. Kagawa immediately obtained it and issued a translation book with the cooperation of Doshisha University in September 1938.

In the preface of his book, Bar mentioned, “The purpose of this book is to describe the actual outline and theory of cooperatives insurance of all the world. As far as I know, this is the first one as the attempt of this kind.”

In addition, he also mentioned, “Cooperatives insurance, in which cooperatives principle is applied in the field of insurance business, is something to compensate for lack of social insurance. It’s not alternative to social insurance exclusively. ”

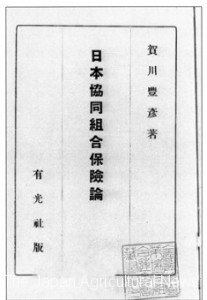

Two years later, Kagawa himself published “Japan cooperatives insurance theory” which could be said Japanese version of it. In it Kagawa forecasted as follows; “It’s not only to protect the health of farmers based on mutual aid, but also to pour the insurance funds back to the rural areas, so that the funds would be utilized for helping the agricultural production and moistening the farm economy.”

On the other hand, a certain year, sangyokumiai (cooperatives) side had also discussed on insurance business. It was 1925. Gonichi Kodaira (1884 – 1976, later vice chairman of chuonogyokai (central agricultural institution), later president of Ienohikarikyokai (Ienohikari association)), associate director of sangyokumiai (cooperatives), former government officials of the Ministry of Agriculture and Commerce, published a paper entitled “Desiring drastic revision of cooperatives law” to the 25th anniversary of the promulgation of sangyokumiai (cooperatives) law. In this paper, Kodaira claimed, “Cooperatives should be allowed the insurance business by extending the business range.” He also mentioned as follows; “Denial of insurance business of cooperatives could be tremendous defect of the realization of the purpose of sangyokumiai (cooperatives). From the spirit of reciprocity, there is no other thing that represents the spirit of insurance business than cooperatives.” In addition, he introduced European precedents examples of cooperatives insurance in each country and described, “It is to share with each other the damage caused by unforeseen disaster so as not to disturb the industrial economy. It is also important business for sangyokumiai (cooperatives) as mutual institution. Its insurance premium should be considered as a kind of savings.” He showed the willingness to run the insurance business by cooperatives.

Such idea was brewed in and out of the sangyokumiai (cooperatives) side. Cooperatives’ movement for starting insurance business entered into the new phase.

Reference = Toyohiko Kagawa “The Land of Milk and Honey” Ienohikarikyokai, Toyohiko Kagawa “Japan cooperatives insurance theory” Arimitsusha, Noah Bar (supervised by Kazuya Mizushima) “Co-operative insurance” Japan Cooperatives Insurance Study Group general incorporated association, National Mutual Insurance Federation of Agricultural Cooperatives ed. “Evolution History of Agricultural Cooperatives Mutual Insurance” the Federation