Sprout in northern limit area of rice cultivation

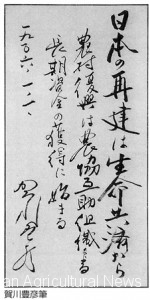

Toyohiko Kagawa’s calligraphy, which hangs on the executive conference room of JA Kyosairen, Hirakawacho, Tokyo, was written that “Japan’s reconstruction starts from life kyosai (mutual insurance), rural reconstruction starts from obtaining long-term funds by mutual aid organization of nokyo (agricultural cooperatives).” (provided by JA Kyosairen)

In the end of 1945 after the end of the war, Kitami branch of prefectural nogyokai (agricultural institution) of Hokkaido (Hokuno) had been studying on “measures for funds to rescue poverty”. This region was the northern limit area of rice cultivation and had been plagued by cold weather. But if the climate became stable, it was one of the largest agricultural areas in Hokkaido island.

Buying food trippers from the city was flooded in the post-war food shortages. Its sales money was sleeping in the chest of drawers of the farmers and was not put into nogyokai (agricultural institution) as deposit. Due to inflation many deposit was drew and deposit balance was decreased.

In December, the meeting for general manager of credit division of local-level nogyokai (agricultural institution) was held. Kameo Katayama, general affairs section chief of Kitami branch, claimed, “In order to make breakthrough against this situation, it is necessary to ask farmers to put deposit in nogyokai (agricultural institution) so as to set up the self-funding system.” After the meeting, Katayama returned to the branch office.

Sanshiro Takaya, secretary of livestock insurance cooperatives of Abashiri spoke to him. Since the insurance cooperatives had been entrusted its business to branch office of Hokuno, Takaya was concurrently in charge of general affairs section staff of the branch.

He spoke to Katayama, who was also his boss. “I think that the savings scheme is useless. Sucked up deposit would go out immediately. We should consider the absolute way to avoid flowing out. I think life insurance is best for it. Shall we try it?”

Katayama, who had been extremely desperate, jumped to agree with the proposal of Takaya. Takaya began activity with Minoru Yoshida, who had experienced working at the Abashiri office of some insurance company.

Regarding the mortality statistics as the basic data of life insurance business, Takaya and his colleagues examined it by visiting the branch office of Hokkaido prefectural office. “There is no nice documentation. Maybe Hokkaido prefectural office is as well as here. Let’s collect the documents in Tokyo.” Then they went to Tokyo. Takaya walked along bookstores district of Kanda. He bought books on insurance actuarial and insurance contract so as to study them by himself. He acted in secret to the Ministry of Agriculture and Forestry. If the prefectural federation of Hokkaido of nogyo-hoken-kumiai (agricultural insurance associations) (Nohoren) knew the existence of the staff of Kitami branch office of Hokuno who was developing life insurance, there had been some possibility that Nohoren would disturb such development.

Attempt following livestock insurance was failed

One day, in Tokyo, he accidentally met with Kichitaro Ashino, secretary of Nohoren, and stayed in the same hotel. Ashino said, “You are familiar with only livestock insurance. It is mistake that such you touch life insurance without receiving any consultation and permission.” Takaya answered, “Because only Kitami branch office of Hokuno carries out this, it’s not necessary to consult the headquarters.” Then they discussed.

Takaya originally planned voluntary kyosai (mutual insurance) business inspired by livestock insurance. Livestock insurance had the mechanism to insure the death and disease of horses and cattle. “If considered on human instead of horse as insurance subject, human life insurance could be developed,” he considered.

And he also claimed, “Regarding voluntary kyosai (mutual insurance) business by nogyokai (agricultural institution), we should develop the undeveloped areas that other organizations and institutions had not ever carried out. We should focus on life and buildings kyosai (mutual insurance), by letting Kyoei Fire run the short-term kyosai (mutual insurance) business.”

Soon, owing to Tkakaya’s hard efforts to create, the outline of “saigai-kyosai (disaster mutual insurance)” as life kyosai (mutual insurance) and “kaoku-kosei-kyosai (house revival mutual insurance)“ as buildings kyosai (mutual insurance) were completed. Its mechanism was consisted of local-level nogyokai (agricultural institution) functioning as insurer and nogyo-hoken-kumiai (agricultural insurance association) functioning as re-insurer.

Later Takaya said that it had been a desperate preparedness to proceed with the “life kyosai (mutual insurance).” Because there had been some possibility to be arrested on suspicion of quasi-insurance claimed by the Ministry of Finance. However, Takaya believed that “life kyosai (mutual insurance) is right as measure to rescue the farmers,” and expanded the range of accident covered by life kyosai (mutual insurance), which any insurance company had not expanded. Life kyosai (mutual insurance) provided medical benefits for a particular disease, and also focused on return of funds such as scholarship funds or housing funds. He pursued the possibility of kyosai (mutual insurance) business in full, in order to solve rural area’s facing problem. And in June 1947, it was approved from the Governor of Hokkaido.

There was another person who had kept thinking on kyosai (mutual insurance) in Hokkaido. The person was Ashino, who had discussed with Takaya in Tokyo. Ashino had become to consider “kyosai (mutual insurance)” helping each other as the most appropriate insurance business.

However, in November of the year, nokyo law was promulgated. Voluntary kyosai (mutual insurance) became the business run by nokyo (agricultural cooperatives). Kyosai (mutual insurance) devised by Kitami branch of nogyokai (agricultural institution) could not see the light of day.

Reference = Taiichi Kurokawa “A path in the desert, 50 years of medical care and mutual insurance movement,” Ienohikarikyokai, Prefectural Mutual Insurance Federation of Hokkaido of Agricultural Cooperatives “Two decades history of Kyosairen Hokkaido” and “Three decades history of Kyosairen Hokkaido” the Federation, National Mutual Insurance Federation of Agricultural Cooperatives ed. “Evolution History of Agricultural Cooperatives Mutual Insurance” the Federation, Noriaki Niwata & Hitoshi Hirata “History and Reality of Cooperatives insurance” Cooperatives insurance Study Group