Investigating Committee supposed institutionalization

After the war, the Allied Forces General Headquarters (GHQ) carried out the occupation policy one after another such as dissolution of Zaibatsu (financial combine group) and antitrust. There was also GHQ’s intention to unify regulation of the financial institutions including insurance companies.

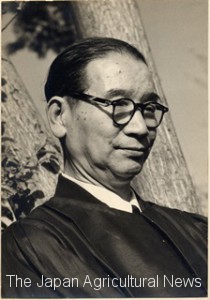

On 5 December 1945 shortly after the war, the Ministry of Finance established Financial System Investigating Committee (the primary). The committee began to consider for all financial institutions system including Bank of Japan, commercial banks, insurance companies, and securities companies. The members from scholars and each industry participated the committee. At the time, Toyohiko Kagawa, who had served as chairman of the Japan Cooperatives Alliance, was the member of the Fourth Committee of it to discuss the insurance business.

In the Fourth Committee, Kagawa insisted the institutionalization of insurance by cooperatives that he had claimed for a long time. The commercial insurance industry claimed the opposite theory such as “(Insurance by the cooperatives) would lead to adverse effects by too many establishment of insurance cooperatives” and “would reduce dissemination force of life insurance.” But the committee supposed “Permission of the insurance cooperatives in the Insurance Business Law” into the draft report on the insurance system as follows;

“As well as stock company and mutual company, under the supervision of the Minister of Finance, insurance cooperatives shall be allowed to run insurance business. However, for the protection for policyholders, approval of establishment of insurance cooperatives should be run strictly. In addition, its management of assets and operating costs should be supervised as well as the insurance company.”

In response to this, the Expert Committee for amendment of Insurance Business Law, which had been installed insides of Investigating Committee, reported as follows; “In addition to stock company and mutual company, insurance cooperatives should be allowed to run insurance business in the form prescribed in the current Insurance Business Law.” It is said that at that time the Ministry of Finance also had recognized the necessity to amend Insurance Business Law and admit cooperatives insurance.

It was the content in line with Kagawa’s claim such as “cooperatives insurance should be recognized in the Insurance Business Law.” Driven by this, various cooperatives organizations such as the zenkokunogyokai (national agricultural institution) and Norinchukin Bank formed “Cooperatives Insurance Study Group” for its promotion and strengthening. Its office managed by Kyoei Fire was located insides of Japan Cooperatives Alliance. Study Group began to expand the activities such as interviewing stakeholders and lobbying to related organizations.

Industry counterattack capsized the approval

However, the situation was completely changed. Financial System Investigating Committee was to be reorganized. It was said to be by emperor’s edict. On 10 December 1946, the (primary) committee was abolished. Instead, government controlled Financial System Investigation Committee (second) was newly established as an advisory body to the Minister of Finance. New members appointed by the cabinet were deputy governor of Bank of Japan, vice president of Sumitomo Bank, vice president of Nomura Securities, bank employee union, scholars, and representatives of lawmakers of both Parliament. There were lined many stakeholders of commercial insurance industry. There was no name of Toyohiko Kagawa anywhere. Representatives of cooperatives instead of him was not also found.

The second committee abolished the first report and started to reconsider in all new. In the second phase, So Adachi, president of Kyoei Fire, who became the special member of Property Insurance Subcommittee, was the only person able to reflect cooperatives side opinion indirectly.

Cooperatives Insurance Study Group continued to run activity even after that. The group invited and interviewed staff of the Ministry of Finance and Ministry of Agriculture and Forestry. However, ministries staff explained on only legislative purpose of nogyokyodokumiai (agricultural cooperatives) bill, which had been in the process of planning at that time and did not touch the cooperatives insurance.

The second Financial System Investigation Committee was progressed in deliberations in the commercial industry pace. In June, the Property Insurance Subcommittee of Fourth Special Committee submitted interim report summarizing discussion. This report did not argue aggressively but expressed passive reputation on cooperatives insurance mentioning, “Penetration by cooperatives is naturally expected.” That was not all. Some of questions had been enumerated.

There was no air of trying to implement the cooperatives insurance in the committee. Counterattack by commercial insurance industry was beginning to reflect.

Life Insurance Subcommittee was more serious. The subcommittee reported “There is no reason to deny the existence of cooperatives insurance, but great expectations are impossible.” This situation continued even after that. On 15 November, the committee reported the final draft of report to the Finance Minister and was dissolved.

Realization of cooperatives insurance was not succeeded by the frontal attack of the revision of the Insurance Business Law. The attempt was squashed by the force of commercial insurance industry beginning to rebound from the post-war chaos.

Reference = Institute of cooperative management “History of Nogyokyodokumiai (agricultural cooperatives) system Volume 2″ , National Mutual Insurance Federation of Agricultural Cooperatives ed. “Evolution History of Agricultural Cooperatives Mutual Insurance” the Federation, Noriaki Niwata & Hitoshi Hirata “History and Reality of Cooperatives insurance” Cooperatives insurance Study Group, Kojiro Sakai “History of Mutual Insurance Business” Japan Cooperatives Insurance Association Incorporated