TOKYO,Aug.27 – Many new-wave wagashi, traditional Japanese confections, are hitting the market, responding to the changing preferences and lifestyles of consumers who want to live a healthy life and have long-life wagashi. Some confectioneries introduced new ingredients to add value, for example, to win over a wide variety of consumers. Such efforts are providing a tailwind to the wagashi market, which is now back on a recovery track thanks to the stay-at-home consumption rising from the Covid-19 pandemic. (Writer: Chika Oyama)

■Traditional Dorayaki for health-conscious people

Eitaro Sohonpo Co. Ltd. (Chuo Ward, Tokyo) sells a new delicious and healthy sweet, “Slow-calorie Dorayaki (260 yen per piece),” at its main shop in Nihonbashi and online.

The Japanese confection shop with 200 years of history uses azuki beans and flour from Hokkaido, which have pleasing flavors, to produce the palm-size treat made from sweet azuki bean paste and two round pancakes. It features the use of a palatinose sweetener that tastes good and is said to moderate the rise in blood glucose levels.

In 2017, the company launched a new brand, “Karadani-eitaro (meaning “it’s good for your health” in Japanese), to meet diversifying demand in the market and the needs of its long-standing customers in their 60s and 70s who worry about their blood sugar levels. The brand is now popular, particularly among sweet lovers in their 30s and 40s who want to “enjoy wagashi with no feeling of guilt.” “They are delicious and rich in dietary fiber and keep your stomachs happy for a long time,” Eitaro says.

■Frozen fresh Daifuku rice dumplings

Imuraya Confectionery Co., Ltd. (Tsu City, Mie Prefecture) introduced “Four pieces of Daifuku (with Tsubu-an red bean paste)” as one of its ready-for-home frozen Japanese sweets series products at an open price.

They are made from Hiyoku Mochi glutinous chewy rice grown in Saga Prefecture. Freezing the dumplings right after production is the key to keeping them fresh and tasty. The frequency of people shopping is decreasing, the time spent at home is growing, and the company found the opportunity to expand the frozen Japanese confectionery series. The series is popular among a wide range of customers, particularly in their 40s to 60s and above.

“We see a chance to expand the frozen wagashi market by attracting elderly customers. We’ll be also able to make them popular among younger generations by innovating a good combination of Japanese and Western styles,” the company says.

■Low-calorie mitarashi dumpling flavor tofu

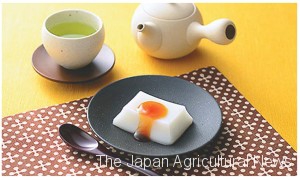

Ichimasa Kamaboko Co., Ltd. (Niigata City, Niigata Prefecture) released “Mitarashi Dumpling Flavor Tofu” on August 18 as a seasonal product at 300 yen (suggested retail price including tax). The new-style tofu-based dessert can be purchased at supermarkets all over Japan.

One of its ingredients, komeko rice flour, gives it a texture like traditional mochi dumplings. It comes with a sweet soy-based sauce called mitarashi. The company’s Japanese-style dessert series is now gathering attention on social networking services (SNS) as “low-calorie guilt-free sweets.” The company developed the latest product in the series to win the hearts of the lovers of one of the top favorite Japanese sweets. Each piece is 65 grams, which is just right in size. “It has fewer calories than a regular mitarashi dango dumpling so that you can have it more often as a snack or an after-meal dessert,” the company says.

■Demand for domestic azuki beans growing with recovering wagashi consumption

According to the All-Nippon Kashi Association, a confectionery association in Japan, the production of Japanese sweets in 2021 is estimated at 350.9 billion yen. It declined 8.9% compared to five years ago as the demand for gifts for business meetings and souvenirs declined due to the Covid-19 pandemic. However, the production grew 7.0% compared to last year, reflecting the growth in stay-at-home consumption.

The prices of azuki beans, which are often used for Japanese confections, remain at a high level due to rising market prices for imported beans and a decrease in production, and there are concerns about supply. While the domestic demand is increasing, the domestic acreage is declining. Stable production that meets the market is critical. There are also strong calls from long-established Japanese confectionery stores to increase domestic production of the ingredients.