Hirobumi Senbongi

Kumamoto

As negotiators work to conclude the Japan-Australia economic partnership agreement, domestic cattle breeders are increasingly worried about the impact of possible reduction in tariffs on Australian beef.

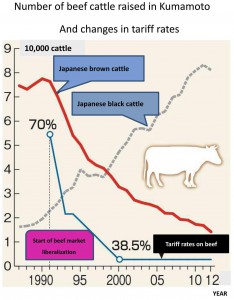

In Kumamoto Prefecture, a major beef production area, prices of Japanese brown cattle plummeted after the liberalization of Japan’s beef market in 1991 followed by reduction in tariffs on beef imports. As a result, the number of Japanese brown cattle raised in the prefecture dropped more than 80 percent compared with the time before the liberalization, and the number of beef producers also declined by 80 percent.

Farmers, who had gone through such experience in the past, are strongly asking the government and the ruling Liberal Democratic Party to meet the Diet resolution on the Japan-Australia EPA which calls on the two nations to exempt key agricultural products including beef from tariff elimination or make them subject to separate negotiations in the future.

The tariff on beef, which used to be 70 percent, was decreased to 38.5 percent in 2000. Due to the lower tariff, imports of low-price lean beef increased, hitting hard on cattle farmers in Kumamoto, whose main business was Japanese brown cattle production. The price of Japanese brown cattle carcasses dropped 34 percent in 2001 compared with the price before tariff reduction. The price of calves declined 33 percent. The Ministry of Agriculture, Forestry and Fisheries analyzed the price declines to the fact that the grade of fat marbling of Japanese brown cattle beef used to be lower and its brand was less well-established at the time.

The tariff on beef, which used to be 70 percent, was decreased to 38.5 percent in 2000. Due to the lower tariff, imports of low-price lean beef increased, hitting hard on cattle farmers in Kumamoto, whose main business was Japanese brown cattle production. The price of Japanese brown cattle carcasses dropped 34 percent in 2001 compared with the price before tariff reduction. The price of calves declined 33 percent. The Ministry of Agriculture, Forestry and Fisheries analyzed the price declines to the fact that the grade of fat marbling of Japanese brown cattle beef used to be lower and its brand was less well-established at the time.

Kazutaka Tominaga, 57, a cattle breeder in Kumamoto, changed his breed from Japanese brown cattle to premium Japanese black cattle to protect his business from the impact of liberalization. But he is still worried over the EPA’s possible damage on Japanese beef, because he believes Australian negotiators are insisting that Australian beef does not compete with Japanese beef only as a means to justify their demand for tariff reduction.

Japanese black cattle has become the main breed produced in Kumamoto in place of Japanese brown cattle, but the production has reached its peak due to concerns over possible tariff reductions and feed prices remaining high. In Japan’s beef market, Japanese black cattle is ranked at the top followed by region-specified breeds such as Japanese brown cattle, and then by crossbred F1 cattle and Holstein bulls, but Tominaga says he has seen prices of all ranks go up and down together. If imports of low-price Australian beef increase, prices of moderately-priced domestic beef will drop, and even prices of Japanese black beef cannot avoid declining, he says.

Another concern is that Australian cattle breeders are recently putting strength into producing grain-fed beef such as the Wagyu brand. In addition to their low price, the taste of such beef is said to resemble that of low-fat beef taken from Japanese brown cattle, whose demand is increasing in Japan along with growing health awareness among consumers. The Kumamoto association of livestock breeders’ agricultural cooperatives is working on increasing production of Japanese brown cattle by carrying out embryo transfers on dairy cows, but such efforts could come to nothing if tariffs on Australian beef are lowered.

Tominaga takes care of 49 lactating cows with his wife Fumiko. They have been struggling to stabilize their business through such measures as completely self-supplying roughage for their cows in a six-hectare farmland. They realize the need to make investments to expand their farm size, but they say it is difficult in reality. Both of them have physical limits and Tominaga says he cannot ask his two sons to succeed the farm unless it is a business which can provide salaries to business partners.

In Kumamoto, more family-run cattle farms are giving up farming against the backdrop of the EPA negotiations and Japan’s participation in the Trans-Pacific Partnership free-trade talks. Tominaga is concerned that with less number of cattle breeders, it will become more difficult for cattle farmers to compete, consult with one another and cooperate to raise their voices against the government.

In the business of beef cattle fattening, with the number of corporation-operated farms raising thousands of cattle on the increase, clear distinction is seen between large-scale farms and family-owned farms lacking sufficient funds. Yuji Honda, general manager of the Kumamoto association, says he is worried that such trend can accelerate if market liberalization proceeds with the conclusion of the EPA, making it even harder for family farms to survive.

Cattle breeding in Kumamoto have contributed to protecting the region’s farmlands and landscapes through putting cattle out to pasturelands in the Aso caldera regions and producing roughage using abandoned farmlands and rice paddies in the Amakusa region. Honda says maintaining such multifunctionality of cattle farming is becoming more difficult along with the aging of farmers, warning that further market liberalization could give a final blow to such regional farming.

(April 3, 2014)