Senior Staff Writer, Masaru Yamada

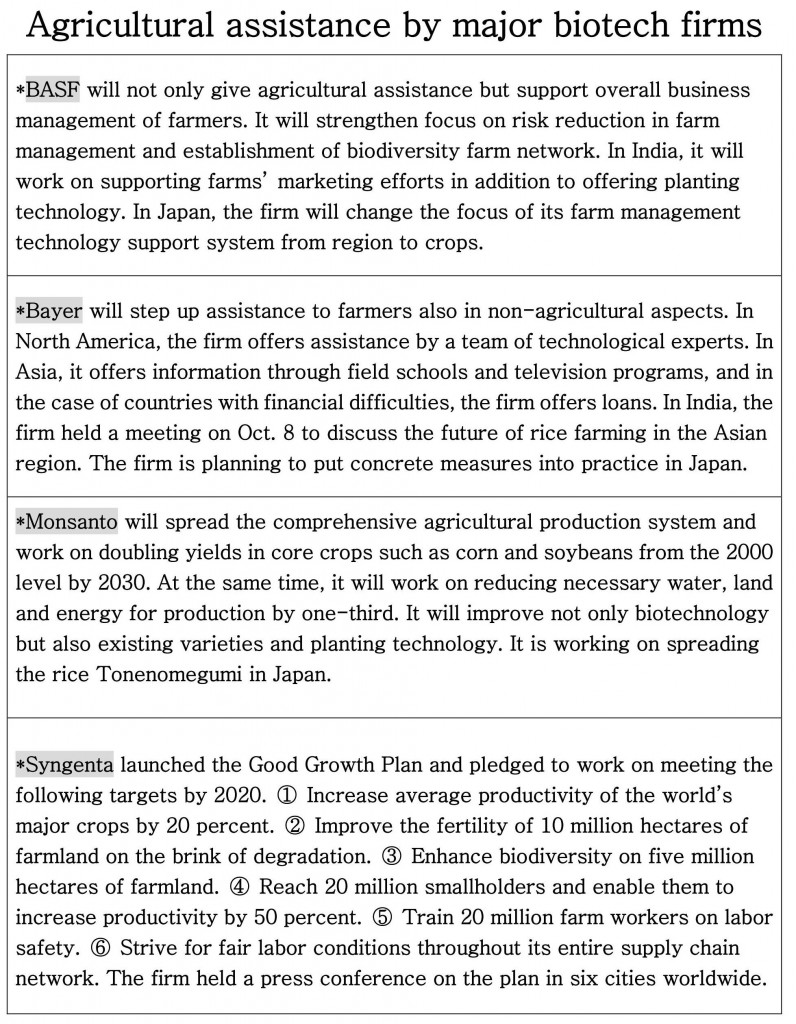

A training staff explains rice planting methods to local farmers at Syngenta AG’s training center in the suburb of Jakarta.

Biotechnology companies worldwide have begun stepping up technological assistance to farms in developing nations in addition to supplying agricultural chemicals. The firms set up ambitious goals such as setting a target year to improve productivity of the farms while saving energy. As the agricultural biotechnology market in industrialized countries has become increasingly saturated, firms are looking to emerging markets with the aim of gaining market share by appealing their marketing skills and production technology of agricultural products to farmers and retaining customers.

In a major rice-growing region in Indonesia, three-hour drive away from Jakarta, local farmers gathered at a training center to listen to a lecture on rice farming, while their children crowded around four big corn-shaped mascots.

The lecture was held by the world’s leading agribusiness firm Syngenta AG to offer information on its rice farming technology named “Grow More.” Since growing hybrid rice by crossing different varieties is not yet common in Indonesia, the firm started teaching the technology to local farmers using conventional varieties about two years ago.

Syngenta officials say that by appropriately managing the timing of supplying water, fertilizers and agricultural chemicals, Indonesian farmers can increase crops by 30 percent compared with conventional farming. The model one-hectare rice paddy at the training center will be open to local farmers throughout the year, and the firm offers lectures and consultation services. Some 100 journalists and environmental group staff were also invited to see the firm’s training program.

Mahatma Maman, 72, owner of 15 hectares of farmland who attended the event, said he has been using Syngenta’s agricultural chemicals and fertilizers. He said he can now harvest seven tons of rough rice from a hectare of land thanks to Syngenta’s technical guidance, adding that he can fully recover the cost for the materials.

Syngenta is not the only example. Most of the major biotechnology companies are already competing fiercely in the Indonesian market. BASF established a center to teach corn and rice growing technology in an effort to take root in the country. An engineer of Indonesia’s Agriculture Ministry explains that since the government’s agricultural training system is insufficient, farmers have to depend on private companies’ training programs.

Indonesia, with a population of 250 million, produces 65 million tons of rough rice and 20 million tons of corn. Currently, most farmers use conventional varieties and plant them by hand, but application of fertilizers, agricultural chemicals and machinery are gradually spreading, creating a market with huge potential for biotech firms.

Major biotech companies are announcing assistance programs for agricultural production and farmers worldwide. In mid-September, Syngenta held a press conference in six cities worldwide to launch the “Good Growth Plan,” comprised of six commitments with ambitious measurable targets to address the global food security challenge. The firm set a target of increasing average productivity of the world’s major crops by 20 percent by 2020. It also created specific plans according to each region, and plans to implement concrete measures to realize the plans. BASF, Bayer and Monsanto also started a broad range of services for farmers, including supply of seeds and agricultural chemicals, technological and management advice, sales support and loans.

All of the companies share the common goal of improving agricultural productivity mainly in developing nations, as they see urgent need to respond to growing global demand for food.

Agricultural chemicals and seed business is still in its initial stage in developing countries. Genetically modified seeds are increasing rapidly in such countries, and their demand is likely to grow to the level of industrialized nations in the near future. This is why agribusiness firms are eager to retain farmers in developing nations from an early stage to get ahead of others in future market competition.

(Oct. 27, 2013)